Consumer confidence has returned to the levels of early 2013, rising slightly relative to the previous month. In general, the relevant index has shown little movement during the current year. The reverting of optimism about the future of the economy to the levels of last October is the most important development, relative to November. Also noteworthy is the improvement in expectations regarding the course of inflation.

The Consumer Climate Index – CCI (59.8) rose (+3.1 points) relative to the previous month. The two component indices show opposite trends. The Current Economic Conditions Index – CECI (41.2) declined by 3.1 points compared to November, whilst in contrast, the Consumer Expectations Index – CEI (72.2) reverted to the levels of June 2013, registering a significant increase (+7.2 points) in the space of one month.

Propensity to buy (59.5) reached the lowest levels of 2013, registering a steep decline (-9 points) relative to the previous month. Just 1 in 4 (24%) believe that the current period is appropriate for major purchases of household equipment (furniture, electrical appliances, etc.). Assessments of personal financial situation (23) improved (+2.8 points relative to November) for the second straight month. Nevertheless, 8 in 10 citizens (79%) report that their personal financial situation has deteriorated during the past 12 months. Expectations of personal financial situation (50) improved marginally (+1.9 points) compared to the previous month. Despite the relative improvement in the index over the past two months, only 8% of respondents anticipate an improvement in their personal financial situation during the coming 12 months. Short-term and long-term expectations for the economy improved considerably. More specifically, short-term expectations (62) rose by 7.8 points relative to November, while long-term expectations (104.7) again broke the ‘psychological’ barrier of 100 points, registering a sharp increase of 12 points, in the same period. Some 19% of respondents express optimism about the economy over the coming year, and when the time span is increased to the next five years, the proportion of those foreseeing recovery of the economy rises to 40%.

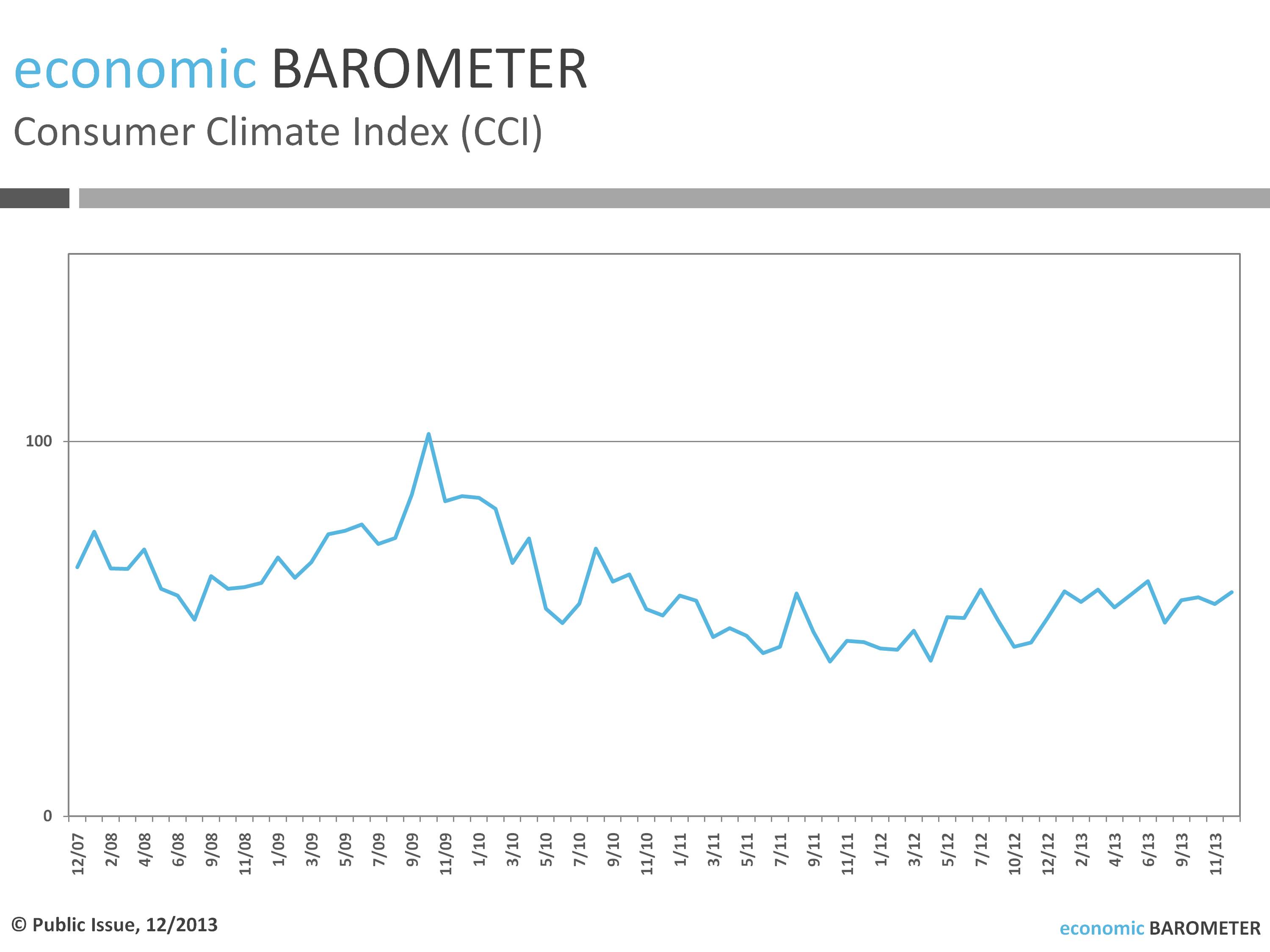

Since the beginning of 2013, consumer confidence has rebounded strongly. The relevant index has shown remarkable stability around the 58-point mark, though with sharp fluctuations on account of major political and economic factors during the course of the year (developments in Cyprus, closure of state broadcaster ERT, withdrawal of Democratic Left from the three-party coalition government, serious problems in the education and health sectors, etc.). Despite little movement in the consumer climate index, the Current Economic Conditions Index and the Consumer Expectations Index showed opposite trends during 2013. The former moved upward, with total gains of 4.4 points (41.2 points in December, up from 36.8 points in January) and the latter downward, with total losses of 3.3 points (72.2 points in December, down from 75.5 points in January).

Assessments and expectations relating to personal financial situation improved markedly during 2013. Assessments rose in total by 10 points (23 points in December, up from 13 points in January) whilst expectations increased by 7.4 points (50 points in December, up from 42.6 in January). On the other hand, optimism about the future of the economy declined significantly over the course of the current year. Expectations for the economy fell by a total of 9.3 points (62 points in December, down from 71.3 in January) and expectations for the economy over the next five years dropped by 7.9 points (104.7 points in December, down from 112.6 in January). However, citizens’ expectations for the future, not only for the economy but also their personal financial situation remain at higher levels relative to their assessments concerning current economic conditions. The yearly average (for 2013) for assessments of personal financial situation is estimated at just 17.4 points, whilst the corresponding average for expectations of personal financial situation is estimated at 47.3 points and in the case of expectations for the economy at 59.5 points for the coming 12 months and 101.9 points for the next five years.

Citizens’ expectations for unemployment and saving changed little. Just 1 in 10 (9%, +1% relative to November) anticipate a drop in unemployment during the coming 12 months. Some 9 in 10 (94%, +1% relative to November) feel they will not be able to save any money in the year ahead. In contrast, expectations for inflation improved considerably. The percentage of those expecting prices to drop in the next 12 months (16%, +4% relative to the previous month) reached the highest point of the past nine months (4/2013-12/2013), rising for the third consecutive month. The relevant index has risen by nearly 7% in total during the three-month period 10/2013-12/2013.