Following Greece’s recourse to the International Monetary Fund and the signing of the Memorandum (2010), living conditions in the country have deteriorated, with the result that many citizens lack material goods or are unable to meet their financial obligations (such as the payment of rent, taxes, bills, loans, etc.). At the present conjuncture, one of the issues taking on particular importance is that of the loans held by households and the capacity to repay them.

Decrease in loans held

According to Public Issue’s data for 2012, 4 in 10 households in Greece (41%) have received a bank loan (Figure 1). Nationwide, this percentage translates into approximately 1,541,735 households(1). In the majority of cases they are home loans (25%), followed with smaller percentages by consumer loans (10%), auto loans (4%), professional loans (4%) and home repair loans (3%) (Figure 2).

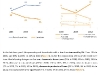

In the last four years(2), the percentage of households with a loan has decreased by 8%. From 49% in 2008, and 43% in 2009, to 41% in 2012 (Figure 3). As for the composition of household credit over time, the following changes can be seen: Increase in home loans (21% in 2008, 16% in 2009, 25% in 2012), decrease in consumer loans (15% in 2008, 15% in 2009, 10% in 2012), decrease in auto loans (7% in 2008, 7% in 2009, 4% in 2012), decrease in professional loans (5% in 2008, 4% in 2009, 4% in 2012) and decrease in home repair loans (4% in 2008, 3% in 2009, 3% in 2012) (Figure 4).

A strong correlation emerges between loans and type of household. The proportion of married couples with children who have received a loan is 45%, of married couples with no children 43%, of unmarried couples living together 41% and of single people living alone just 31% (Figure 5). This phenomenon denotes that the probability of holding a loan is consistent with the increased social obligations of the citizens.

The households that have loans belong mainly to the middle (44%) and lower (42%) social strata and, to a lesser extent, to the upper-bourgeoisie (27%) (Figure 5). This picture is confirmed also on the basis of the indicator that measures subjective assessment of disposable income: almost 1 in 2 households (45%) facing financial difficulties have received a loan of some sort, whilst the corresponding proportion for financially stable households is 31%, i.e. less than 1 in 3 (Figure 5).

The taking out of loans is far more prevalent among households in urban centers. In the large cities of the country, nearly 4 in 10 households (44%) have received a bank loan, whilst the corresponding proportion in semi-urban and rural areas is 36% and 35% respectively (Figure 5).

Increased difficulty of repayment

Regarding the issue of the timely servicing of loans, almost 3 in 4 households (78%) report difficulties in paying monthly installments, while a further 6% are completely unable to make repayments (Figure 6). The total percentage, nearly 84%, is considerably higher compared to the past (measurements by Public Issue before the signing of the Memorandum). More specifically, for 2009 and 2008, for which relevant data are available, the proportion of households finding it difficult to repay loans was 60% and 65% respectively (Figure 7).

In greater detail, the difficulty of servicing loans over time has increased as follows: Home loans (from 58% in 2008, and 62% in 2009, to 86% in 2012), Consumer loans (78% in 2008, 68% in 2009, 86% in 2012), Auto loans (66% in 2008, 58% in 2009, 79% in 2012), Professional loans (67% in 2008, 61% in 2009, 90% in 2012), Home Repair loans (59% in 2008, 48% in 2009, 82% in 2012) (Figure 8).

In 2012, the households facing the greatest difficulty in paying monthly loan installments are families with children (83%) and households in the lowest social strata (90%) (Figure 9).

Unsurprisingly, the capacity to repay a loan depends directly on income. More specifically, almost 9 in 10 households (92%) that report having financial difficulties are also facing loan repayment problems, whilst the corresponding proportion for households reporting that they are living in relative comfort is 48% (Figure 9).

During the last three years, 3 in 10 households (29%) have secured a special loan repayment arrangement, while in 2% of cases a favorable settlement plan was sought but without result (Figure 10). The percentage of success in securing a repayment arrangement depends on the type of loan, since it is higher for consumer loans (43%) and significantly lower for home loans (25%) (Figure 11). Favorable arrangements are implemented mainly among the economically inactive population (31%), the unemployed (37%) (Figure 12) and households with financial difficulties (31%) (Figure 13).

(1) On the basis of the available estimate of the Hellenic Statistical Authority (ELSTAT), the number of households with at least one member aged 16-74 in Greece is 3,760,329 (see ELSTAT (2012), Survey on the Use of Information and Communication Technologies – 2012, e-Europe Indicators). This figure does not include single-member households with individuals aged 75 and over.

(2) For information about loans held by households before 2007, see Bank of Greece (2008), Borrowing and financial pressure on households: Results of the 2007 sample survey, http://www.bankofgreece.gr/, and Theodoros Mitrakos and George Simigiannis (2009), “The Determinants of Greek Household Indebtedness and Financial Stress”, Bank of Greece, Economic Bulletin, Issue 32, pp. 7-29.