Even before the emergence of the economic crisis in 2008, the extremely deep crisis of confidence in institutions, which had become apparent in Greece, included banks too(1).

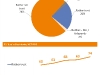

Given that banks have found themselves at the epicenter of criticism, on account of their responsibility for the crisis, public confidence in them has constantly declined during the past six years (2007-2013). According to a recent survey by Public Issue, almost 3 in 4 Greeks (74%) today report a lack of confidence in banks, whilst just 22%, i.e. less than 1 in 4, continue to have confidence in them (Figure 1). However, in the past two years, the level of public disillusionment with banks remained high and rose by just 5% (from 69% in May 2011, to 74% in April 2013, whilst relative to a corresponding survey in 2007 (before the crisis) the total increase in the six-year period is 14%, from 60% in 2007 to 74% in 2013 (Figure 2).

Meanwhile, the new European policy on deposits which was implemented in Cyprus has caused the public’s pervasive sense of insecurity to spread also to deposits. Today in Greece, about 7 in 10 respondents (72%) believe that their deposits are at risk and only 26% of citizens (1 in 5) consider that they remain “very” or “fairly” safe (Figure 3).

Indeed, roughly 4 in 10 Greeks (43%) consider deposits to be “barely” safe, compared to just 4% who believe that they are “very” safe (Figure 4). It is worth noting that in November 2011, before the private sector involvement (PSI), the corresponding percentages were 35% (“very”/”fairly” safe) and 55% (“not very”/”barely” safe, Figure 5).

(1) See Public Issue: Greek Index of Confidence in Institutions (GICI), 2007. Available online at: http://www.publicissue.gr/27/institutions/